Contingent Consideration Arrangements in Business Combinations

Kevin Kalayjian Eli Seller Mio Aura Carson Angress

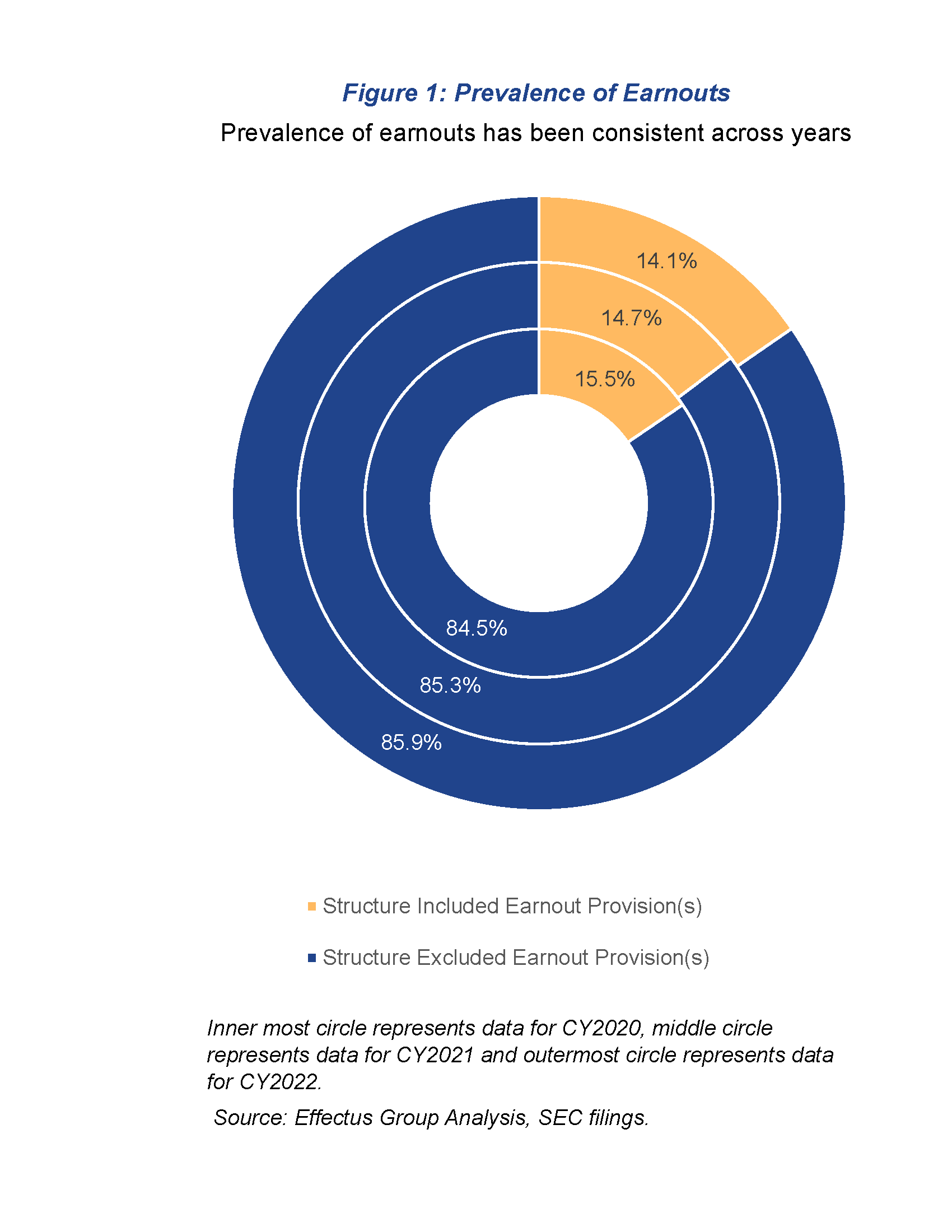

In the merger and acquisition landscape, transactions often include a variety of types of consideration transferred from the buyer, or acquirer, to the seller, including cash and the acquirer’s equity instruments. The buyer and seller may also agree to have a portion of the purchase price become payable if certain contingencies, milestones, or metrics are met in the post-acquisition period. These arrangements are typically referred to as contingent consideration arrangements, or earnouts, in practice.

Earnouts can be a useful component of the transaction structure when the buyer and seller have differing views on the target company’s valuation and the total consideration to be transferred to acquire the target company or the target’s assets. In these instances, earnouts can be used to bridge a “valuation gap”. Valuation gaps may arise during the negotiations on the value of the target company or its assets, often because of information asymmetry or differing expectations in the growth or profitability profile of the target company. In these cases, incorporating contingent consideration provisions and payments in lieu of the purchase price being paid entirely on the closing date can reduce the risk of the transaction for the acquirer, and can enable the seller to achieve its total desired purchase price if the earnout requirements are met in the post-closing period.

Pursuant to Accounting Standards Codification 805, Business Combinations (“ASC 805”) consideration transferred, including contingent consideration, is measured at fair value on the acquisition date when a transaction is accounted for as a business combination. The accounting for these arrangements can be highly complex and may require a significant degree of judgment. For financial reporting purposes, topics that management may consider when structuring, negotiating and accounting for these types of arrangements include, but are not limited to the following:

This summary discussion and the in-depth report examines the concepts that an acquirer should consider when assessing the appropriate accounting for contingent consideration in business combinations, including classification, measurement and recognition, and factors that impact whether arrangements represent consideration transferred in the business combination under GAAP or compensation to sellers for future services to be rendered. Additionally, the in-depth report presents data related to contingent consideration in business combinations from recent SEC filings as well as examples of common types of arrangements included in business combinations, and the appropriate classification and measurement and recognition conclusions.

Often times, purchase agreements include a clause that offers contingent payments to selling shareholders who will remain as employees of the acquiree or the combined entity, with the contingent payment tied to continuing employment of specified selling shareholders. In such cases, the contingent payments to be made to the selling shareholders are more appropriately accounted for as compensation for services to be provided subsequent to the acquisition date, as opposed to a component of the consideration transferred to sellers of the acquired entity. Prior to assessing the accounting for contingent consideration arrangements in a business combination, the acquirer should first ensure that the arrangement meets the criteria to be accounted for as contingent consideration instead of compensation for future services to be rendered.

Once it has been concluded that an arrangement meets the criteria to be accounted for as contingent consideration, ASC 805-30-25-6 indicates that a contingent consideration arrangement should be classified as either a liability (or an asset) or as equity in accordance with ASC Subtopics 480-10 (Distinguishing Liabilities from Equity – Overall) and ASC 815-40 (Derivatives and Hedging – Contracts in Entity’s Own Equity), or other applicable generally accepted accounting principles (GAAP). In this assessment, the settlement form and which party controls the choice of settlement form, if applicable, is important to understand. Arrangements solely settleable in cash and arrangements settleable in cash or shares, at the election of the seller(s), are liability-classified arrangements. In contrast, arrangements solely settleable in shares or settleable in cash or shares, at the election of the acquirer, may qualify for equity classification if certain conditions are met. When the arrangement is compensation for future services, the acquirer should look to other GAAP, such as Accounting Standards Codification 718, Compensation—Stock Compensation (“ASC 718”), for the appropriate classification.

After determining the appropriate classification of the earnout arrangement, the acquirer must then address the initial measurement and recognition upon the transaction closing. Regardless of the balance sheet classification, contingent consideration is initially measured at fair value in accordance with ASC 805-30-30-7. As previously observed, management teams should also ensure that the earnout arrangement is not accounted for as a separate transaction from the business combination, such as compensation under ASC 718, when assessing the appropriate measurement and recognition basis. When the substance and the nature of the arrangement is compensatory, the acquirer should look to other GAAP for the measurement and recognition basis.

Once the contingent consideration arrangement has been initially measured at the acquisition date, the acquirer must also understand how to account for subsequent changes in the value of such arrangements. Examples of events that would result in changes in the fair value include meeting an earnings target, reaching a milestone on a research and development project, or management determining that it would be unlikely that the applicable earnout targets will be met. Except for measurement period adjustments, which arise from additional information about facts and circumstances that existed at the acquisition date that the acquirer obtained after that date, all other subsequent adjustments to the fair value of the contingent consideration arrangement will be treated as follows:

Regardless of the classification, the acquirer should consider whether facts and circumstances in subsequent periods would have resulted in the reclassification of the arrangement(s). If so, the arrangement may have to be reclassified from a liability to equity or vice versa.

The current accounting guidance with respect to the recognition and measurement of contingent consideration in business combinations contains various complexities and nuances, and improper interpretation of such guidance may result in significant financial reporting consequences and other downstream impacts. It is important to understand the implications of different contingent consideration structures, including how such structures will impact the initial recognition and measurement, the subsequent measurement, and the settlement of the arrangement.

Effectus Group’s team of highly skilled advisors, with extensive experience in the area of complex contingent consideration arrangements in business combinations, is here to help navigate this topic.